Page 45 - NIS English september 01-15, 2022

P. 45

Secured Future Nation

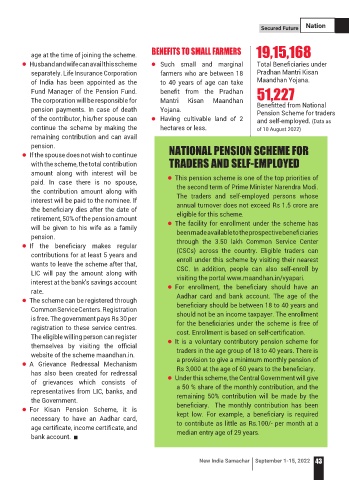

BENEFITS TO SMALL FARMERS 19,15,168

age at the time of joining the scheme.

Husband and wife can avail this scheme Such small and marginal Total Beneficiaries under

n n

separately. Life Insurance Corporation farmers who are between 18 Pradhan Mantri Kisan

of India has been appointed as the to 40 years of age can take Maandhan Yojana.

Fund Manager of the Pension Fund. benefit from the Pradhan 51,227

The corporation will be responsible for Mantri Kisan Maandhan

pension payments. In case of death Yojana. Benefitted from National

Pension Scheme for traders

of the contributor, his/her spouse can n Having cultivable land of 2 and self-employed. (Data as

continue the scheme by making the hectares or less. of 10 August 2022)

remaining contribution and can avail

pension. NATIONAL PENSION SCHEME FOR

If the spouse does not wish to continue

n

with the scheme, the total contribution TRADERS AND SELF-EMPLOYED

amount along with interest will be

paid. In case there is no spouse, n This pension scheme is one of the top priorities of

the contribution amount along with the second term of Prime Minister Narendra Modi.

interest will be paid to the nominee. If The traders and self-employed persons whose

the beneficiary dies after the date of annual turnover does not exceed Rs 1.5 crore are

retirement, 50% of the pension amount eligible for this scheme.

will be given to his wife as a family n The facility for enrollment under the scheme has

pension. been made available to the prospective beneficiaries

If the beneficiary makes regular through the 3.50 lakh Common Service Center

n (CSCs) across the country. Eligible traders can

contributions for at least 5 years and

wants to leave the scheme after that, enroll under this scheme by visiting their nearest

LIC will pay the amount along with CSC. In addition, people can also self-enroll by

interest at the bank's savings account visiting the portal www.maandhan.in/vyapari.

rate. n For enrollment, the beneficiary should have an

The scheme can be registered through Aadhar card and bank account. The age of the

n beneficiary should be between 18 to 40 years and

Common Service Centers. Registration

is free. The government pays Rs 30 per should not be an income taxpayer. The enrollment

registration to these service centres. for the beneficiaries under the scheme is free of

The eligible willing person can register cost. Enrollment is based on self-certification.

themselves by visiting the official n It is a voluntary contributory pension scheme for

website of the scheme maandhan.in. traders in the age group of 18 to 40 years. There is

A Grievance Redressal Mechanism a provision to give a minimum monthly pension of

n Rs 3,000 at the age of 60 years to the beneficiary.

has also been created for redressal

of grievances which consists of n Under this scheme, the Central Government will give

representatives from LIC, banks, and a 50 % share of the monthly contribution, and the

the Government. remaining 50% contribution will be made by the

For Kisan Pension Scheme, it is beneficiary. The monthly contribution has been

n kept low. For example, a beneficiary is required

necessary to have an Aadhar card,

age certificate, income certificate, and to contribute as little as Rs.100/- per month at a

bank account. median entry age of 29 years.

New India Samachar September 1-15, 2022 43