Page 29 - NIS English 16-31 February,2023

P. 29

रुपया कहां जाता है

रुपया कहां से आता है

आ्य करो

ऋण औरो अन््य

(15%)

अन््य व््य्य (8%)

दषे्यताएं (34%)

20 %

केंद्री्य उत्पेाद

शुल्क

करोों औरो शुल्कों मेें

रोाज््यों का हिस््सा

(7%)

केंद्री्य प्ा्योहजत

(18%)

्योजनाएं (9%)

हनगमे करो

(15%)

हित्त आ्योग पेेंशन (4%) ब््याज भुगतान

्सब्ब््सडरी (7%)

करो-रोहित प्ाब््तत्यां (6%) औरो अन््य अंतरोण

(9%)

ऋण- रोहित पेूंजरीगत प्ाब््तत्यों (2%)

िस्तु एिं ्सषेिा ्सरीमेाशुल्क (4%) रोक्ा (8%)

करो औरो अन््य करो केंद्री्य क्षेत्र करी COVER STORY

(17%)

्योजनाएं

(17%) First General Budget of Amrit Kaal

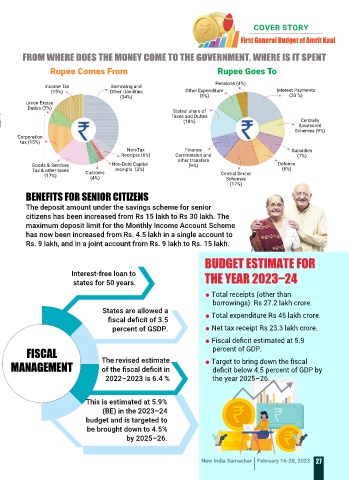

FROM WHERE DOES THE MONEY COME TO THE GOVERNMENT, WHERE IS IT SPENT

Rupee Comes From Rupee Goes To

Pensions (4%)

Income Tax Borrowing and

(15%) Other Liabilities Other Expenditure Interest Payments

(34%) (8%) (20 %)

Union Excise

Duties (7%) States’ share of

Taxes and Duties

(18%) Centrally

Sponsored

Schemes (9%)

Corporation

tax (15%)

Non-Tax Finance Subsidies

Receipts (6%) Commission and (7%)

other transfers

Goods & Services Non-Debt Capital (9%) Defence

Tax & other taxes Customs receipts (2%) (8%)

(17%) (4%) Central Sector

Schemes

(17%)

BENEFITS FOR SENIOR CITIZENS

The deposit amount under the savings scheme for senior

citizens has been increased from Rs 15 lakh to Rs 30 lakh. The

maximum deposit limit for the Monthly Income Account Scheme

has now been increased from Rs. 4.5 lakh in a single account to

Rs. 9 lakh, and in a joint account from Rs. 9 lakh to Rs. 15 lakh.

BUDGET ESTIMATE FOR

Interest-free loan to THE YEAR 2023–24

states for 50 years.

n Total receipts (other than

borrowings): Rs 27.2 lakh crore.

States are allowed a

fiscal deficit of 3.5 n Total expenditure Rs 45 lakh crore.

percent of GSDP. n Net tax receipt Rs 23.3 lakh crore.

n Fiscal deficit estimated at 5.9

FISCAL percent of GDP.

MANAGEMENT The revised estimate n Target to bring down the fiscal

of the fiscal deficit in

deficit below 4.5 percent of GDP by

2022–2023 is 6.4 % the year 2025–26.

This is estimated at 5.9%

(BE) in the 2023–24

budget and is targeted to

be brought down to 4.5%

by 2025–26.

New India Samachar February 16-28, 2023 27