Page 22 - NIS English 01-15 July,2023

P. 22

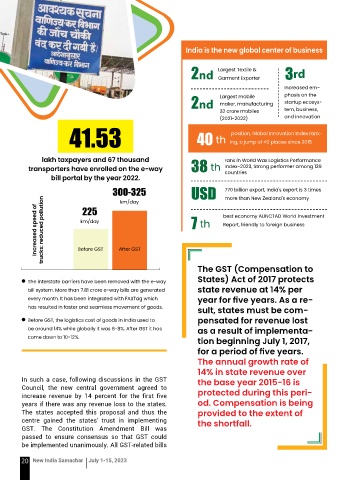

India is the new global center of business

2nd Largest Textile & 3 rd

Garment Exporter

Increased em-

phasis on the

Largest mobile

2nd maker, manufacturing startup ecosys-

32 crore mobiles tem, business,

and innovation

(2021-2022)

41.53 40 th position, Global Innovation Index rank-

ing, a jump of 40 places since 2015

lakh taxpayers and 67 thousand 38 rank in World Wax Logistics Performance

transporters have enrolled on the e-way th Index-2023, Strong performer among 139

countries

bill portal by the year 2022.

300-325 USD 770 billion export, India's export is 3 times

more than New Zealand's economy

km/day

Increased speed of trucks: reduced pollution Before GST After GST 7 th best economy AUNCTAD World Investment

225

km/day

Report, friendly to foreign business

The GST (Compensation to

n The interstate barriers have been removed with the e-way States) Act of 2017 protects

bill system. More than 7.81 crore e-way bills are generated state revenue at 14% per

every month. It has been integrated with FASTag which

year for five years. As a re-

has resulted in faster and seamless movement of goods.

sult, states must be com-

n Before GST, the logistics cost of goods in India used to pensated for revenue lost

be around 14% while globally it was 6-8%. After GST it has

as a result of implementa-

come down to 10-12%.

tion beginning July 1, 2017,

for a period of five years.

The annual growth rate of

14% in state revenue over

In such a case, following discussions in the GST the base year 2015-16 is

Council, the new central government agreed to

increase revenue by 14 percent for the first five protected during this peri-

years if there was any revenue loss to the states. od. Compensation is being

The states accepted this proposal and thus the provided to the extent of

centre gained the states' trust in implementing the shortfall.

GST. The Constitution Amendment Bill was

passed to ensure consensus so that GST could

be implemented unanimously. All GST-related bills

20 New India Samachar July 1-15, 2023