Page 27 - NIS English 01-15 October, 2025

P. 27

New GST Reforms of New India | COVER STORY

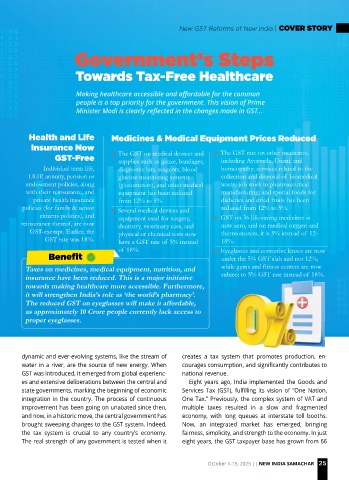

Government’s Steps

Towards Tax-Free Healthcare

Making healthcare accessible and affordable for the common

people is a top priority for the government. This vision of Prime

Minister Modi is clearly reflected in the changes made in GST…

Health and Life Medicines & Medical Equipment Prices Reduced

Insurance Now

GST-Free n The GST on medical devices and n The GST rate on other medicines,

including Ayurveda, Unani, and

supplies such as gauze, bandages,

Individual term life, diagnostic kits, reagents, blood homeopathy; services related to the

ULIP, annuity, pension or glucose monitoring systems collection and disposal of biomedical

endowment policies, along (glucometers), and other medical waste; job work in pharmaceutical

with their reinsurance, and equipment has been reduced manufacturing; and special foods for

private health insurance from 12% to 5%. diabetics and dried fruits has been

policies (for family & senior n Several medical devices and reduced from 12% to 5%.

citizens policies), and equipment used for surgery, n GST on 36 life-saving medicines is

reinsurance thereof, are now dentistry, veterinary care, and now zero, and on medical oxygen and

GST-exempt. Earlier, the physical or chemical tests now thermometers, it is 5% instead of 12-

GST rate was 18%. have a GST rate of 5% instead 18%.

of 18%. n Eyeglasses and corrective lenses are now

Benefit under the 5% GST slab and not 12%,

Taxes on medicines, medical equipment, nutrition, and while gyms and fitness centers are now

insurance have been reduced. This is a major initiative subject to 5% GST rate instead of 18%.

towards making healthcare more accessible. Furthermore,

it will strengthen India’s role as ‘the world’s pharmacy’.

The reduced GST on eyeglasses will make it affordable,

as approximately 10 Crore people currently lack access to

proper eyeglasses.

dynamic and ever-evolving systems, like the stream of creates a tax system that promotes production, en-

water in a river, are the source of new energy. When courages consumption, and significantly contributes to

GST was introduced, it emerged from global experienc- national revenue.

es and extensive deliberations between the central and Eight years ago, India implemented the Goods and

state governments, marking the beginning of economic Services Tax (GST), fulfilling its vision of “One Nation,

integration in the country. The process of continuous One Tax.” Previously, the complex system of VAT and

improvement has been going on unabated since then, multiple taxes resulted in a slow and fragmented

and now, in a historic move, the central government has economy, with long queues at interstate toll booths.

brought sweeping changes to the GST system. Indeed, Now, an integrated market has emerged, bringing

the tax system is crucial to any country’s economy. fairness, simplicity, and strength to the economy. In just

The real strength of any government is tested when it eight years, the GST taxpayer base has grown from 66

October 1-15, 2025 || NEW INDIA SAMACHAR 25