Page 25 - NIS English 01-15 October, 2025

P. 25

New GST Reforms of New India | COVER STORY

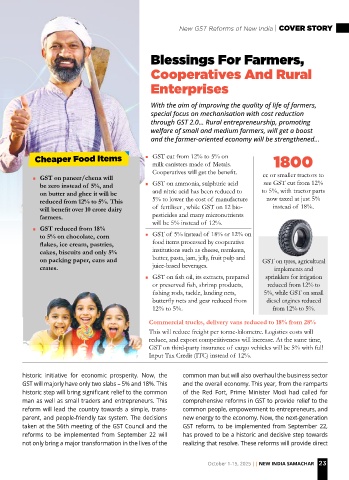

Blessings For Farmers,

Cooperatives And Rural

Enterprises

With the aim of improving the quality of life of farmers,

special focus on mechanisation with cost reduction

through GST 2.0… Rural entrepreneurship, promoting

welfare of small and medium farmers, will get a boost

and the farmer-oriented economy will be strengthened…

Cheaper Food Items n GST cut from 12% to 5% on 1800

milk canisters made of Metals.

Cooperatives will get the benefit.

n GST on paneer/chena will cc or smaller tractors to

be zero instead of 5%, and n GST on ammonia, sulphuric acid see GST cut from 12%

on butter and ghee it will be and nitric acid has been reduced to to 5%, with tractor parts

reduced from 12% to 5%. This 5% to lower the cost of manufacture now taxed at just 5%

will benefit over 10 crore dairy of fertiliser , while GST on 12 bio- instead of 18%.

farmers. pesticides and many micronutrients

will be 5% instead of 12%.

n GST reduced from 18%

to 5% on chocolate, corn n GST of 5% instead of 18% or 12% on

flakes, ice cream, pastries, food items processed by cooperative

cakes, biscuits and only 5% institutions such as cheese, namkeen,

on packing paper, cans and butter, pasta, jam, jelly, fruit pulp and GST on tyres, agricultural

crates. juice-based beverages. implements and

n GST on fish oil, its extracts, prepared sprinklers for irrigation

or preserved fish, shrimp products, reduced from 12% to

fishing rods, tackle, landing nets, 5%, while GST on small

butterfly nets and gear reduced from diesel engines reduced

12% to 5%. from 12% to 5%.

Commercial trucks, delivery vans reduced to 18% from 28%

This will reduce freight per tonne-kilometre. Logistics costs will

reduce, and export competitiveness will increase. At the same time,

GST on third-party insurance of cargo vehicles will be 5% with full

Input Tax Credit (ITC) instead of 12%.

historic initiative for economic prosperity. Now, the common man but will also overhaul the business sector

GST will majorly have only two slabs – 5% and 18%. This and the overall economy. This year, from the ramparts

historic step will bring significant relief to the common of the Red Fort, Prime Minister Modi had called for

man as well as small traders and entrepreneurs. This comprehensive reforms in GST to provide relief to the

reform will lead the country towards a simple, trans- common people, empowerment to entrepreneurs, and

parent, and people-friendly tax system. The decisions new energy to the economy. Now, the next-generation

taken at the 56th meeting of the GST Council and the GST reform, to be implemented from September 22,

reforms to be implemented from September 22 will has proved to be a historic and decisive step towards

not only bring a major transformation in the lives of the realizing that resolve. These reforms will provide direct

October 1-15, 2025 || NEW INDIA SAMACHAR 23