Page 14 - NIS English February 16-28

P. 14

Budget 2 21

Union

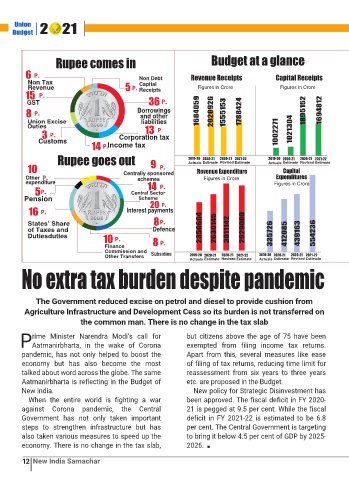

Rupee comes in Budget at a glance

6 P. Revenue Receipts Ca ta Re e t

Non Tax P. Non Debt Figures in Crore Figures in Crore

Capital

Revenue

1 P. Receipts

GST 36 P.

8 P. Borrowings 1 0 9 202092 1 1 17 2 1 9 1 2 1 9 12

and other

Union Excise liabilities

Duties 13 P 1021 0

3 P. 1002271

Corporation tax

Customs 14 P. Income tax

Rupee goes out 9 2019 20 2020 21 2020 21 2021 22 2019 20 2020 21 2020 21 2021 22

10 P. Actuals Estimate Revised Estimate Actuals Estimate Revised Estimate

Ca ta

Revenue Expenditure

Other P. Centrally sponsored Figures in Crore Expenditures

schemes

expenditure 14 P. Figures in Crore

P. Central Sector

Pension Scheme P.

20

16 P. Interest payments

States’ Share 8 P.

of Taxes and Defence 2 0 0 2 01 0111 2 2929000

Dutiesduties 10 P. 8 72 120 439163 2

Finance P.

Commission and

Other Transfers Subsidies 2019 20 2020 21 2020 21 2021 22 2019 20 2020 21 2020 21 2021 22

Actuals Estimate Revised Estimate

Actuals Estimate Revised Estimate

No e t a ta e e te a e

The Government reduced excise on petrol and diesel to provide cushion from

Agriculture Infrastructure and Development Cess so its burden is not transferred on

the common man. There is no change in the tax slab

rime Minister Narendra Modi’s call for but citizens above the age of 75 have been

PAatmanirbharta, in the wake of Corona exempted from filing income tax returns.

pandemic, has not only helped to boost the Apart from this, several measures like ease

economy but has also become the most of filing of tax returns, reducing time limit for

talked about word across the globe. The same reassessment from six years to three years

Aatmanirbharta is reflecting in the Budget of etc. are proposed in the Budget.

New India. New policy for Strategic Disinvestment has

When the entire world is fighting a war been approved. The fiscal deficit in FY 2020-

against Corona pandemic, the Central 21 is pegged at 9.5 per cent. While the fiscal

Government has not only taken important deficit in FY 2021-22 is estimated to be 6.8

steps to strengthen infrastructure but has per cent. The Central Government is targeting

also taken various measures to speed up the to bring it below 4.5 per cent of GDP by 2025-

economy. There is no change in the tax slab, 2026.

12 New India Samachar