Page 20 - NIS English Aug 1-15, 2024

P. 20

Budget

2024-2025

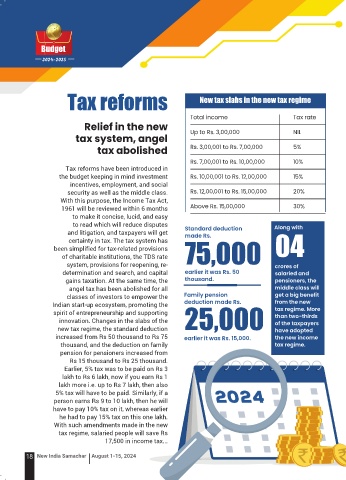

Tax reforms New tax slabs in the new tax regime

Total income Tax rate

Relief in the new

Up to Rs. 3,00,000 NIL

tax system, angel

Rs. 3,00,001 to Rs. 7,00,000 5%

tax abolished

Rs. 7,00,001 to Rs. 10,00,000 10%

Tax reforms have been introduced in

the budget keeping in mind investment Rs. 10,00,001 to Rs. 12,00,000 15%

incentives, employment, and social

security as well as the middle class. Rs. 12,00,001 to Rs. 15,00,000 20%

With this purpose, the Income Tax Act,

1961 will be reviewed within 6 months Above Rs. 15,00,000 30%

to make it concise, lucid, and easy

to read which will reduce disputes Along with

and litigation, and taxpayers will get Standard deduction

made Rs.

certainty in tax. The tax system has 04

been simplified for tax-related provisions 75,000

of charitable institutions, the TDS rate

system, provisions for reopening, re- crores of

determination and search, and capital earlier it was Rs. 50 salaried and

gains taxation. At the same time, the thousand. pensioners, the

angel tax has been abolished for all middle class will

classes of investors to empower the Family pension get a big benefit

new tax regime, the standard deduction 25,000 than two-thirds

Indian start-up ecosystem, promoting the deduction made Rs. from the new

spirit of entrepreneurship and supporting tax regime. More

innovation. Changes in the slabs of the

of the taxpayers

increased from Rs 50 thousand to Rs 75 earlier it was Rs. 15,000. have adopted

the new income

thousand, and the deduction on family tax regime.

pension for pensioners increased from

Rs 15 thousand to Rs 25 thousand.

Earlier, 5% tax was to be paid on Rs 3

lakh to Rs 6 lakh, now if you earn Rs 1

lakh more i.e. up to Rs 7 lakh, then also

5% tax will have to be paid. Similarly, if a

person earns Rs 9 to 10 lakh, then he will

have to pay 10% tax on it, whereas earlier

he had to pay 15% tax on this one lakh.

With such amendments made in the new

tax regime, salaried people will save Rs

17,500 in income tax...

18 New India Samachar August 1-15, 2024

30-07-2024 17:20:56

NIS English AUG 1-15 2024 FINAL. Inf..indd 18 30-07-2024 17:20:56

NIS English AUG 1-15 2024 FINAL. Inf..indd 18